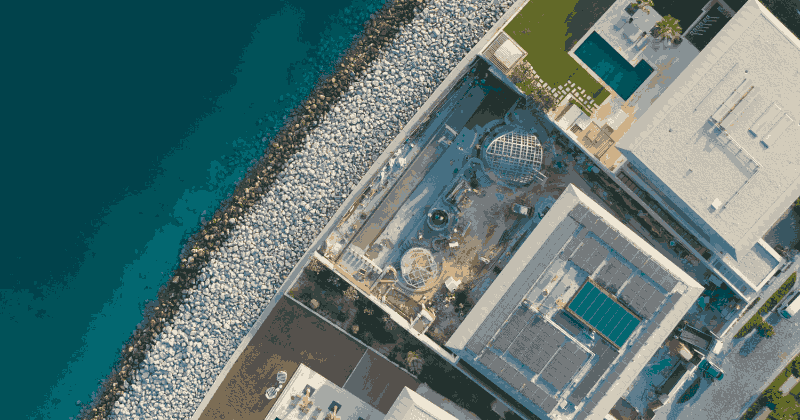

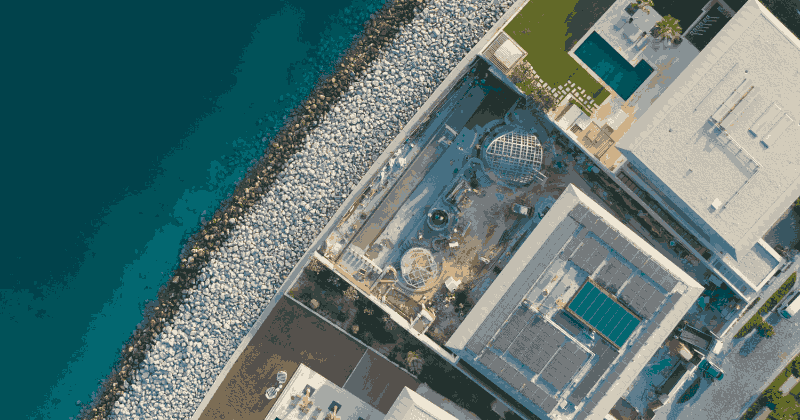

Investing in Dubai’s real estate market offers overseas buyers unparalleled opportunities. From luxurious waterfront properties to high-yield rental investments, Dubai stands as a beacon for global investors. However, navigating the intricacies of securing a mortgage in a foreign country can be daunting. This is where the expertise of mortgage loan consultants becomes invaluable.

Understanding the Mortgage Landscape in Dubai

Dubai’s real estate market is unique, characterized by its rapid growth, diverse property offerings, and a regulatory framework that differs from many countries. For overseas buyers, understanding the nuances of mortgage options, eligibility criteria, and legal requirements is crucial. Mortgage consultants in Dubai specialize in bridging this knowledge gap, offering tailored advice that aligns with international investors’ needs.

Tailored Mortgage Solutions for Overseas Buyers

One of the primary roles of mortgage consultants is to provide personalized mortgage solutions. They assess various factors, including the buyer’s country of residence, income sources, and investment goals, to recommend the most suitable mortgage products. For instance, some banks in Dubai offer mortgages to non-residents, allowing them to finance up to 65% of the property’s value.

Navigating Legal and Regulatory Requirements

Dubai’s property laws and mortgage regulations can be complex for overseas buyers. Mortgage consultants assist in ensuring compliance with the UAE’s legal framework, including the Dubai Land Department’s regulations and the Real Estate Regulatory Agency’s guidelines. They guide buyers through the necessary documentation, such as valid passports, proof of income, and bank statements, ensuring a smooth application process.

Access to a Wide Network of Lenders

Mortgage consultants have established relationships with a broad spectrum of lenders, including local banks and international financial institutions. This network enables them to present overseas buyers with a range of mortgage options, from fixed-rate to variable-rate loans, ensuring competitive interest rates and favorable terms.

Streamlining the Application Process

The mortgage application process in Dubai involves multiple steps, including property valuation, legal checks, and approval from lending institutions. Mortgage consultants act as intermediaries, liaising with banks, legal entities, and property developers to expedite the process. Their expertise ensures that all procedures are followed correctly, reducing the risk of delays or rejections.

Providing Post-Purchase Support

The role of mortgage consultants extends beyond the purchase phase. They offer ongoing support to overseas buyers, assisting with mortgage refinancing, property management, and navigating any challenges that may arise during the loan tenure. This continued assistance ensures that investors can maximize their returns and maintain a hassle-free ownership experience.

Conclusion

For overseas buyers looking to invest in Dubai’s thriving real estate market, partnering with a mortgage loan consultant is a strategic move. Their expertise simplifies the mortgage process and ensures that investors make informed decisions. Trusted brokers like PWF Broker provide comprehensive mortgage consultancy, helping overseas buyers secure the best financing options while navigating the Dubai property market with confidence.