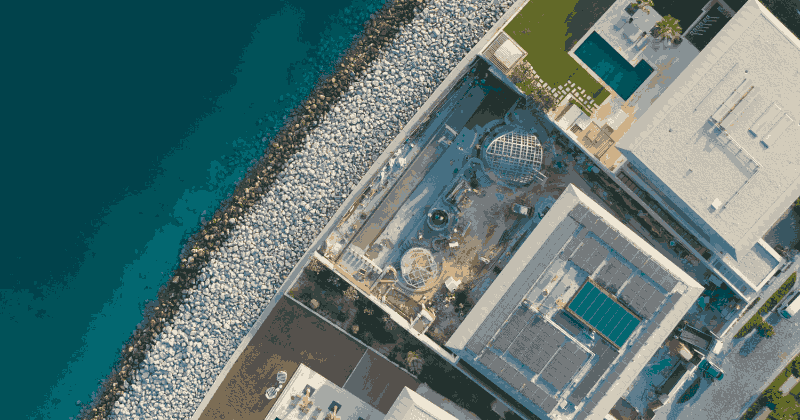

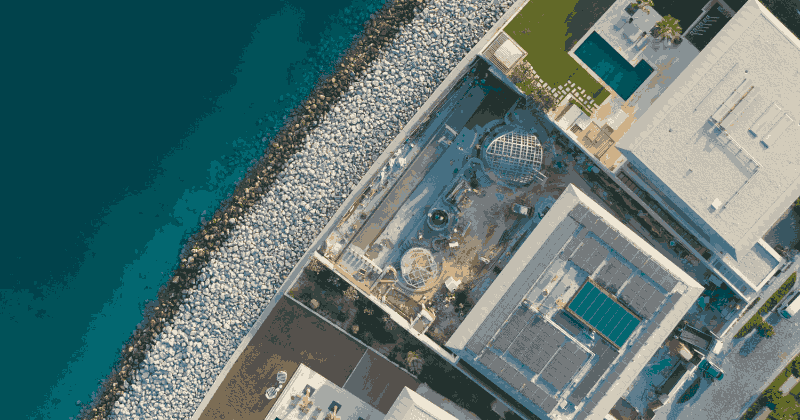

Choosing the right mortgage plan for your home in Dubai goes beyond just numbers—it’s about aligning your investment with the city’s vibrant lifestyle. Dubai offers a dynamic blend of luxury living, modern amenities, and strategic investment opportunities, making the choice of a home a key part of your financial and personal planning. From waterfront apartments in Dubai Marina to spacious villas in Emirates Hills, each property type comes with unique financing needs. A well-structured mortgage plan ensures that you can enjoy the cosmopolitan lifestyle, access world-class facilities, and invest wisely in a city known for its growth and opportunities, all while maintaining financial comfort and flexibility.

Understanding Your Home Buying Goals

Before exploring mortgage options, it’s essential to clearly understand your financial goals. Are you planning to stay in the property for the long term, or is this an investment property? How much can you afford as a monthly repayment without straining your budget? These questions help determine the type of mortgage that suits your lifestyle and financial situation.

A home loan consultant can help you evaluate your income, savings, and expenditure, providing a realistic picture of what you can afford. This step ensures that you choose a mortgage plan that aligns with your goals without causing future financial stress.

Fixed-Rate vs. Variable-Rate Mortgages

One of the first decisions you need to make is whether to opt for a fixed-rate or variable-rate mortgage.

- Fixed-Rate Mortgage: The interest rate remains the same for a specific period, usually 3, 5, or 10 years. This offers predictability in monthly payments and protects you from market fluctuations. Fixed-rate mortgages are ideal for buyers who prefer stability and long-term financial planning.

- Variable-Rate Mortgage: The interest rate fluctuates based on market conditions. While initial rates may be lower than fixed-rate mortgages, monthly payments can increase if interest rates rise. Variable-rate mortgages are suitable for buyers who can tolerate some risk and expect interest rates to remain stable or fall.

A mortgage consultant can analyze your risk tolerance and recommend the most suitable option.

Assessing Your Financial Situation

Mortgage lenders consider multiple factors before approving your application. Your credit score, income, outstanding debts, and employment stability play a crucial role in determining the interest rate you qualify for.

Working with a home loan consultant ensures that you are aware of your eligibility and the documentation required for a smooth mortgage approval process. They can also provide tips to improve your credit score, helping you secure better rates and terms.

Comparing Mortgage Plans

Every lender offers different mortgage plans with varying interest rates, repayment terms, and fees. A thorough comparison is essential to identify the plan that offers the best value.

A mortgage consultant can help you compare options across multiple banks and financial institutions. They provide insights into hidden fees, early repayment penalties, and flexible repayment options that may not be apparent at first glance. This professional guidance ensures you make an informed decision without being overwhelmed by complex terms and fine print.

Considering Additional Costs

Apart from monthly repayments, buying a home involves other costs such as property registration fees, insurance, and maintenance expenses. Failing to account for these can strain your finances.

A home loan consultant can provide a detailed breakdown of all costs associated with your mortgage plan, helping you budget effectively. They can also suggest financial strategies to manage these expenses without impacting your lifestyle.

Planning for the Future

Your mortgage plan should not only meet your current needs but also accommodate future changes in your life. Consider factors such as career growth, family expansion, and potential relocation when selecting a mortgage.

Professional mortgage consultants can help you design a mortgage strategy that offers flexibility, allowing you to adjust repayment schedules or refinance in the future without penalties. This proactive approach ensures long-term financial stability and peace of mind.

Why Choose a Mortgage Consultant

Navigating the mortgage market can be confusing, especially for first-time buyers. Mortgage consultants bring expertise, market knowledge, and negotiation skills to the table. They save you time, reduce stress, and ensure that you secure the most suitable mortgage plan for your needs.

By leveraging their experience, you benefit from:

- Access to exclusive mortgage deals

- Personalized advice tailored to your financial situation

- Assistance with paperwork and loan approval

- Strategies to reduce interest costs and repayment burdens

Final Thoughts

Choosing the right mortgage plan is a crucial step in your home-buying journey. It requires careful assessment of your financial situation, understanding of mortgage types, and comparison of available options. With the guidance of mortgage consultants and a reliable home loan consultant, you can make an informed decision that secures your dream home while maintaining financial stability.

Investing time in professional advice today will pay off in years of peace of mind and financial security. If you are planning to buy a home, consult a trusted mortgage expert to explore the best options tailored for your unique needs.